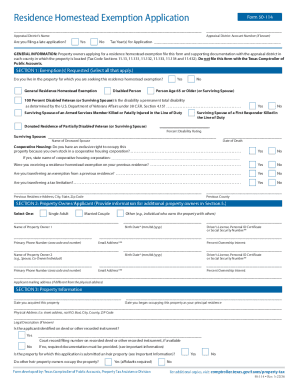

TX Comptroller 50-114 2013 free printable template

Get, Create, Make and Sign

Editing form 50 114 online

TX Comptroller 50-114 Form Versions

How to fill out form 50 114 2013

How to fill out form 50 114:

Who needs form 50 114:

Video instructions and help with filling out and completing form 50 114

Instructions and Help about how to fill out form 50 114 texas

Hello this is Rowland and Olivia with the right choice group and Remix North San Antonio in today's video we are going to teach you how to successfully fill out your Texas homestead exemption form for 2019 now if you purchase a home in 2018 now is the time for you to complete this four that's exactly right we need to fill that out anytime between January 1st and April 30th so what we're going to do in this video today is walk you through the homestead exemption form for the state of Texas line-by-line will show you exactly what you need to fill out and where you need to send it in order for you to qualify for your 2019 Texas homestead exemption okay so let's go ahead and show you exactly where to get this form now I'm going to provide a link to the form in the video description, so you don't have to worry about doing this but in case you wanted to know how to find it all you have to do is Google 2019 Texas homestead exemption form and what we're looking for is this form PDF 5 0 – 1 1 4 that's your homestead exemption form from the Texas Comptroller office, and I'll show you exactly what you need to do just pull it up and this is what we're looking at here in the state of Texas for your residence homestead exemption application so what you want to do on the top, so we're here in bare county so what we're going to do is put bare county appraisal district whatever county that you're in you'll just need to google that or look it up and that's basically the county that you're going to want to send this form to so in our case here in San Antonio Texas we're a bear county appraisal district if you know the appraisal districts account number you could put it up here it is not required if you want to Google your bear county or your counties appraisal tax district number, and you can do that as well and put that up here in the upper right-hand corner, so the first question is going to ask us do you own and live in the property for which you're syncing this residence homestead exemption so obviously in this case we're going to want to go ahead and put yes, and you're going to put when you're applying for your exemption so if you bought the home in 2018 which you would have to have bought this home in 2018 in order to file for an exemption in 2019, so that's one thing you need to know if you bought a home in 2019 you're going after wait until 2020 to file your homestead exemption, so that's really important so in this case we're going to put 2018 or if you're watching this video, and you haven't done a homestead exemption, and you bought same 2017 what you have a father, yet that's fine go ahead and click on that you'll put 2017 in that year assuming that this is the first time you filed for a Texas homestead exemption the other thing to note is that once you file for a homestead exemption in the state of Texas you do not have to file for it again it will be on place for the entire time that you own that home moving forward and presuming you buy another...

Fill property tax form 50 114 texas : Try Risk Free

People Also Ask about form 50 114

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 50 114 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.