TX Comptroller 50-114 2013 free printable template

Show details

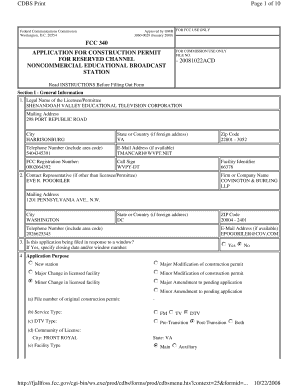

50-114 Rev. 01-08/13 YEAR APPLICATION FOR RESIDENCE HOMESTEAD EXEMPTION To complete this form see the instructions on back of this form. Appraisal District Name Phone Area code and number Address For appraisal district office use only Step 1 Owner s name and address attach sheets if needed. Legal Description Parcel Number Owner s Name person completing application Current Mailing Address City State ZIP Code Driver s License Personal ID Certificate or Social Security Number Birth Date Percent...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-114

Edit your TX Comptroller 50-114 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-114 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-114 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 50-114. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-114 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-114

How to fill out TX Comptroller 50-114

01

Obtain the TX Comptroller form 50-114, titled 'Application for 100% Disabled Veteran Exemption'.

02

Fill in the applicant's name at the top of the form.

03

Enter the applicant's address in the designated fields.

04

Provide the applicant's social security number.

05

Indicate the personal information of the veteran, including military service details.

06

Attach supporting documentation, such as proof of disability from the U.S. Department of Veterans Affairs.

07

Sign and date the application at the bottom of the form.

08

Submit the completed form and all attached documents to your local appraisal district.

Who needs TX Comptroller 50-114?

01

Texas residents who are 100% disabled veterans seeking a property tax exemption on their primary residence.

02

Surviving spouses of deceased disabled veterans may also need this form to apply for the exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is a residential homestead exemption in Texas?

A homestead exemption in Texas is a tax break applied to your primary residence. It can lower your property taxes by exempting a portion of the value of your home from taxation. The amount of the exemption varies depending on the county in which you live, but it can be up to 20% of the appraised value of your home.

How much does a homestead exemption save you in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

What is the new homestead rule in Texas?

“This bill will save every homestead $341 a year on top of the existing exemption, $454, totaling $795 per year in these exemptions.” Lawmakers in both chambers will likely approve the proposition, which will go on the November 2023 ballot.

What is the homestead exemption in Texas 2023?

You may file an Application for Residential Homestead Exemption (PDF) with your appraisal district for the $25,000 homestead exemption up to two years after the taxes on the homestead are due. Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application.

How does a Texas resident create a homestead?

How do I apply for a homestead exemption? You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

Who qualifies for homestead exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX Comptroller 50-114 online?

pdfFiller has made it easy to fill out and sign TX Comptroller 50-114. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit TX Comptroller 50-114 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing TX Comptroller 50-114.

How can I fill out TX Comptroller 50-114 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your TX Comptroller 50-114. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX Comptroller 50-114?

TX Comptroller 50-114 is a form used in Texas for providing certain information regarding property tax exemptions for various types of property, typically related to exemption claims.

Who is required to file TX Comptroller 50-114?

Property owners who are claiming exemptions for their property are required to file TX Comptroller 50-114 with the local appraisal district to ensure compliance with state tax laws.

How to fill out TX Comptroller 50-114?

To fill out TX Comptroller 50-114, you need to provide necessary details such as your identifying information, type of exemption, the property description, and any supporting documentation that relates to the exemption being claimed.

What is the purpose of TX Comptroller 50-114?

The purpose of TX Comptroller 50-114 is to collect information from property owners to determine eligibility for property tax exemptions in Texas, thus ensuring proper assessment and taxation.

What information must be reported on TX Comptroller 50-114?

The information that must be reported on TX Comptroller 50-114 includes the property owner's name and address, the property identification number, the type of exemption being claimed, and other relevant details pertaining to the property and the exemption eligibility.

Fill out your TX Comptroller 50-114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-114 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.